Property Related Services

We can offer or refer all the services you’ll need to find, buy and manage your property. Having one contact will make things a lot easier.

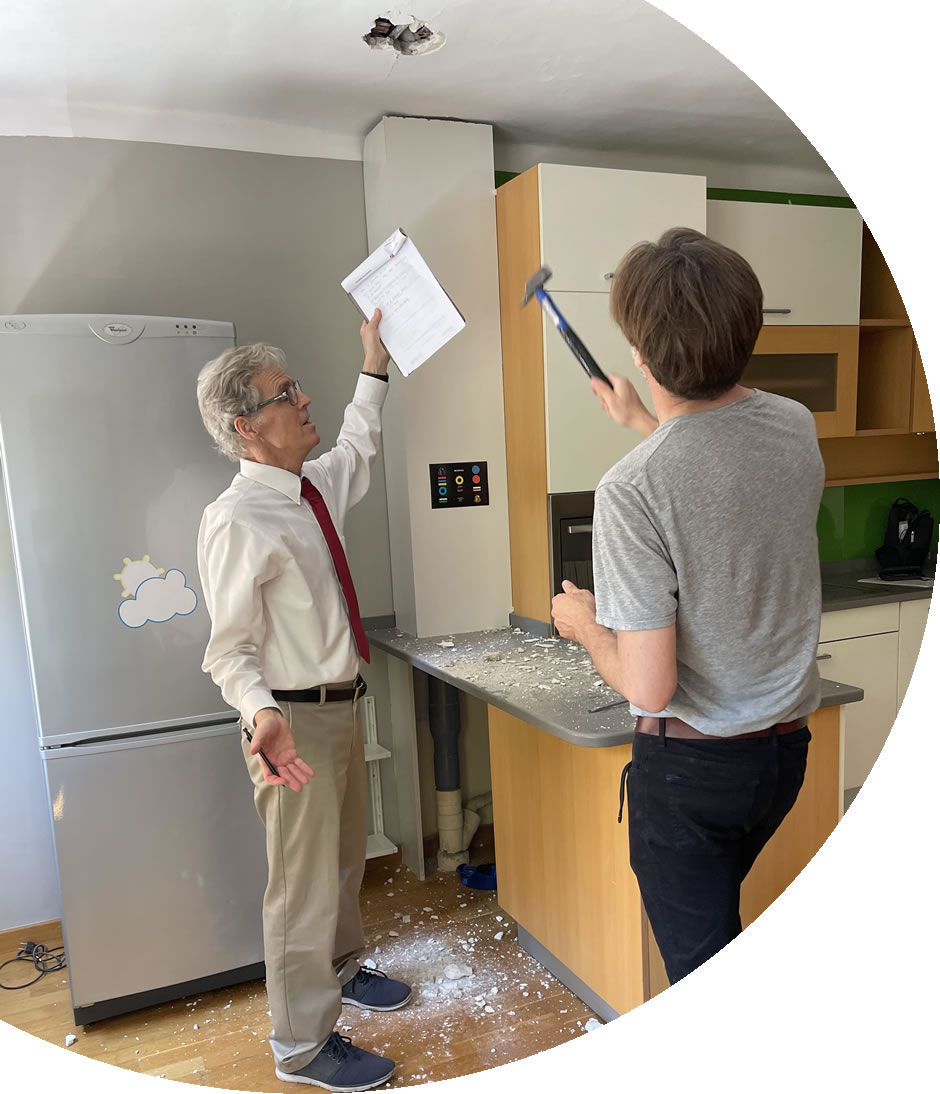

Arquitect Carlos Casablancas and I in a property inspecting for water damage.

Related Services

Mortgage

Spanish Banks Lend to Foreigners

This is the first step. Spanish banks love lending to foreigners, but the process takes time. Contact some banks and send them your financial documents to get ‘pre-approval’ before or while you’re visiting properties; or hire a mortgage broker. We recommend Mortgage Direct.

Banks focus on your current monthly income and current monthly debts. They ask for your last six monthly paycheck stubs, or similar proof, your latest income tax return, and your monthly debt payments. If these debt payments exceed 35% of your monthly income, you will probably be denied.

Amount Granted. For a Spanish tax resident, i.e. someone who files a tax return in Spain, the cap is 80% of the lower between the purchase price and the property assessment. For a non-Spanish tax resident, the cap ranges from 50% to 70%. Only a few lenders will exceed these. The interest rates as of Feb. 2025 range from 2.5% to 4% for up to 30 years. A good time to borrow.

Our Partners. Contact us for referrals to some trusted banks and mortgage providers in Barcelona.

Mortgage Direct. They’re an intermediate between you and the bank. You send them your financial documents and they search the market for the best terms. They’ve helped a lot of our clients. Click on the box below for more information.

Spanish Bank Account

You Must Open One

You must have a bank account in Spain to pay property taxes and other bills by direct debit. It’s also best to pay for the property from a Spanish bank. For some banks, you just need your passport to open the account and you can start making small transfers immediately. You will have to go into the bank and sign for it within a reasonable time. We work with two of Spain’s largest banks.

Money Transfer

Don’t Transfer Bank to Bank

In our long experience, using the currency broker ‘Currencies Direct’ to transfer funds to Spain saves you a lot of money. They use a much better exchange rate than banks and specialize in large transfers for real estate purchases. An agent will call you personally to walk you through the process. Having someone on the phone is important. Click on the box below to request a free quote.

How do currency brokers work? They open an account for you in two different banks: one in your country and one in Spain. You transfer to the bank in your country, then at your request, the broker releases the money in euros to your bank account in Spain. Thus, there is no transfer; your money simply goes into their bank in your country and is released from their bank in Spain. This is one reason they cost less than banks and why they advertise ‘no transfer fees’.

Real Estate Agents

No License Needed

In Spain, you don’t need a license to sell real estate, anyone can do it. Further, some ‘agents’ charge the buyer normally 3% of the purchase price + 21% VAT, but omit this fee from the listed price; so the price you see online is wrong. We work with true and tested agents that we can recommend. To do so, please complete the search criteria form below and send it to us. We won’t send you spam.

Spanish NIE

Required to Buy Property

A NIE is a tax ID number and is needed to apply for a mortgage and to sign the property deed. It’s best to apply at the nearest Spanish Consulate in your home country. You can apply in Barcelona, but it takes longer. If in Barcelona, we recommend ‘NIE Barcelona’. Our clients have given us positive feedback about them.

Tax Advice

Another Essential Service

You must understand your potential tax exposure in Spain. Taxes in Spain are high and it’s a tricky subject. We can recommend some tax attorneys who specialize in advising foreigners. Here are some key points:

1) Know your tax liability before you become a Spanish tax resident. A Spanish tax resident is someone who meets one of the following:

- You live in Spain for more than 183 days in a calendar year. They don’t have to be consecutive or ‘in a row’.

- Your main source of income comes from Spain or

- Your spouse and/or minor children live in Spain.

2) If you are a Spanish tax resident, you must report your worldwide income in Spain and pay taxes on it. This includes the capital gain from property or stock sales, money gifted, inheritance, and almost any other increase to your wealth. It does not matter where you realize the gain or receive the gift. Once you get it, it’s a tax event in Spain.

3) Best Advice: Sell your property, your shares of stock, receive your give, etc., in the year prior to residing in Spain for more than 183 days. If you acquire the money as a Spanish tax resident, you’ll be subject to Spain’s capital gains tax and/or gift tax of app. 20% and up.

Property Inspection

Architects & Renovaters

It’s best to hire a property inspection before you commit to buy, especially in Barcelona’s Gothic Quarter. Further, you can save a lot of money buying property that needs some fixing up. We work with several experienced local architects and renovation experts who can assist. They inspect for structural defects, water leaks, advise on taking out walls, installing a new kitchen, and related issues.

Post-Purchase Services

Rental Management & Leasing

After you sign the deed, you’ll need to change the name on the utility bills, install internet, maybe an alarm, etc. If you plan to rent, you’ll need to consult a property management company, draft binding leases, screen tenants and/or hire someone to watch the place while you’re away. We can recommend services for all these common requests.

Power of Attorney

We Do It for You

If you can’t be in Barcelona to sign the deed, apply for a NIE, pay a tax, or for almost anything else, we can do it for you via a power of attorney. It’s best to sign it in Barcelona or at the nearest Spanish consulate.

Our Partners

Buying Criteria

The Spanish NIE: Understanding the Spanish tax ID number

Mark explains the two different types of Spanish NIE’s.

For some advice, check our articles

The TOTAL Cost of

Buying Property in Barcelona

The Arras Contract in Spain

Spain’s Golden Visa